Corin Faife

vice.com

Originally posted 18 MAY 23

Here are two excerpts:

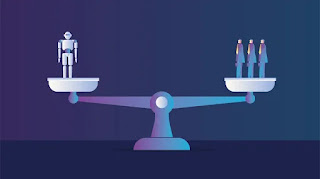

The prospect of automated AI systems making phone calls to distressed people adds another dystopian element to an industry that has long targeted poor and marginalized people. Debt collection and enforcement is far more likely to occur in Black communities than white ones, and research has shown that predatory debt and interest rates exacerbate poverty by keeping people trapped in a never-ending cycle.

In recent years, borrowers in the US have been piling on debt. In the fourth quarter of 2022, household debt rose to a record $16.9 trillion according to the New York Federal Reserve, accompanied by an increase in delinquency rates on larger debt obligations like mortgages and auto loans. Outstanding credit card balances are at record levels, too. The pandemic generated a huge boom in online spending, and besides traditional credit cards, younger spenders were also hooked by fintech startups pushing new finance products, like the extremely popular “buy now, pay later” model of Klarna, Sezzle, Quadpay and the like.

So debt is mounting, and with interest rates up, more and more people are missing payments. That means more outstanding debts being passed on to collection, giving the industry a chance to sprinkle some AI onto the age-old process of prodding, coaxing, and pressuring people to pay up.

For an insight into how this works, we need look no further than the sales copy of companies that make debt collection software. Here, products are described in a mix of generic corp-speak and dystopian portent: SmartAction, another conversational AI product like Skit, has a debt collection offering that claims to help with “alleviating the negative feelings customers might experience with a human during an uncomfortable process”—because they’ll surely be more comfortable trying to negotiate payments with a robot instead.

(cut)

“Striking the right balance between assertiveness and empathy is a significant challenge in debt collection,” the company writes in the blog post, which claims GPT-4 has the ability to be “firm and compassionate” with customers.

When algorithmic, dynamically optimized systems are applied to sensitive areas like credit and finance, there’s a real possibility that bias is being unknowingly introduced. A McKinsey report into digital collections strategies plainly suggests that AI can be used to identify and segment customers by risk profile—i.e. credit score plus whatever other data points the lender can factor in—and fine-tune contact techniques accordingly.