Sarah Cascone

artnet.com

Originally posted 9 DEC 21

The Metropolitan Museum of Art in New York has dropped the Sackler name from its building. The move is perhaps the museum world’s most prominent cutting of ties with the disgraced family since their company Purdue Pharma’s guilty plea to criminal charges connected to marketing of addictive painkiller OxyContin in 2020.

The decision, which came after more than a yearlong review by the museum, was reportedly mutual and made “in order to allow the Met to further its core mission,” according to a joint statement issued by the Sackler family and the institution.

“Our families have always strongly supported the Met, and we believe this to be in the best interest of the museum and the important mission that it serves,” the descendants of Mortimer Sackler and Raymond Sackler said in a statement. “The earliest of these gifts were made almost 50 years ago, and now we are passing the torch to others who might wish to step forward to support the museum.”

Institutions have faced increasing pressure to sever relations with the Sacklers in recent years as part of a growing push to hold institutions and other cultural groups accountable over where their money is coming from. (Other donors that have come under fire include arms dealers and oil companies.)

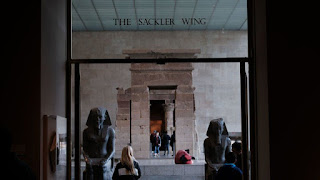

Seven spaces at the Fifth Avenue flagship bore the Sackler name. The biggest was the Sackler Wing, which opened in 1978, and includes the Sackler Gallery for Egyptian Art, the Temple of Dendur in the Sackler Wing, and the 1987 addition of the Sackler Wing Galleries.

The day of the announcement, Patrick Radden Keefe, the author of Empire of Pain: The Secret History of the Sackler Dynasty, visited the museum to find that the family’s name had already been removed.